Total control over tax debts and liabilities

Gain full visibility into tax debts, outstanding issues, and active tax liabilities across all jurisdictions. eStracta continuously monitors the company’s tax status and delivers an always up-to-date diagnosis, ready to support analysis and decision-making

Hidden tax debts compromise business management

Companies with high tax complexity deal with debts and outstanding issues spread across multiple systems and government agencies. Often, these liabilities are only identified when they already prevent the issuance of tax clearance certificates or generate financial impact.

The lack of a consolidated view makes control difficult, increases risk, and turns tax management into a reactive process rather than a strategic one.

Tax issues only surface once they cause operational blocks or restrictions.

Information scattered across accounts, statements, and government offices makes control difficult.

Without a clear diagnosis, resolving issues becomes slow and imprecise.

Spreadsheets and isolated queries increase errors and rework.

How eStracta controls tax debts and liabilities

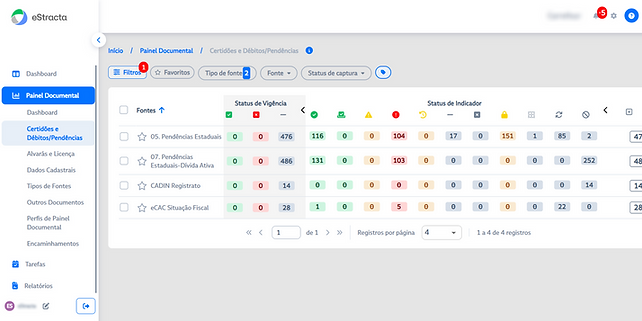

The Debt and Tax Liability Control module automates tax monitoring by centralizing critical information and maintaining a continuously updated tax diagnosis.

1

Continuous monitoring of tax status

The platform automatically tracks tax accounts, tax audits, debt statements, outstanding issues, and active tax liabilities.

2

Consolidation and intelligent diagnosis

All information is organized and correlated, clearly identifying what affects tax compliance.

3

Action and ongoing tracking

New, settled, or updated debts are highlighted, ensuring control and predictability.

Main module features

Features designed to deliver accurate tax diagnostics, full visibility, and continuous control over debts and outstanding issues

Comprehensive tax status monitoring

Automatically track tax accounts, audits, debt statements, outstanding issues, and active liabilities across tax authorities.

Identification of blockers for Tax Clearance Certificates

The system links debts and issues that prevent the issuance of tax clearance certificates (CNDs), simplifying compliance.

Payment slip generation

Streamline your workflow with automatic generation of payment slips, reducing errors and rework.

Debt comparison by period

Quickly identify new, settled, or modified debts and issues within a selected period.

Always up-to-date tax diagnosis

Access a consolidated, real-time view of the company’s tax situation at any time.

Full visibility into tax debts

Immediate clarity on the company’s true tax position, with no blind spots.

Reduced tax risks and surprises

Identify issues before they result in blocks, penalties, or restrictions.

Greater predictability and control

Track debt evolution and make decisions based on reliable data.

Strong foundation for audits and compliance

Maintain history, traceability, and audit-ready information.

Choose eStracta as the governance layer for your operation

eStracta was built to support complex operations in legal, tax, and regulatory environments, combining robust technology, human support, and a flexible business model aligned with the reality of large enterprises.

Nationwide coverage, over 1,000 active digital agents, and a secure, scalable SaaS platform designed for governance

Human support and unlimited training to ensure adoption and long-term success

Flexible subscription with no long-term commitment, costs proportional to your operation, and fast implementation

Companies that live legal, tax, and regulatory compliance in practice

Companies with high legal, tax, and regulatory complexity trust eStracta to reduce risk, gain efficiency, and elevate their governance standards.